sted Shorts: Meta’s new AI model, Apple’s $14B India move, Tesla regains top spot, and $12B in Bitcoin ET

In today’s edition

- Meta and Open AI’s new AI models

- China’s trade decline

- Apple’s India strategy

- Tesla’s challenges

- Q1 2024: Crypto market review

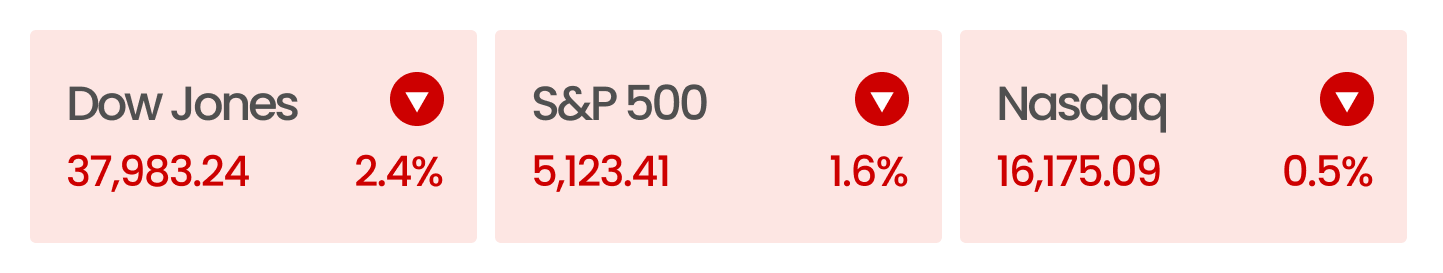

Market Snapshot

The major US stock indices closed lower amid escalating Middle East tensions and lackluster financial results from key banks. JPMorgan Chase led the downturn, with its shares tumbling over 6% after forecasting weaker-than-expected net interest income for 2024, which overshadowed its stronger first-quarter earnings.

Other banking heavyweights, including Citigroup and Wells Fargo, experienced declines in their stock prices after reporting their quarterly earnings. The financial sector’s challenges were exacerbated by a sharp increase in oil prices; WTI Crude Oil futures soared to a five-month high of over $87 per barrel, fueled by reports of a potential conflict between Israel and Iran. This combination of disappointing corporate earnings and rising geopolitical tensions led to a widespread sell-off in the markets.

Stock market closing data for the week from April 8th to 12th, 2024

News Summaries

OpenAI and Meta (Explore: META) are nearing the launch of advanced AI models designed to significantly elevate machine cognition by introducing capabilities such as reasoning and planning, marking a considerable step toward achieving artificial general intelligence. These improvements aim to enable AI to handle complex sequences of tasks and anticipate the outcomes of their actions, moving beyond simple, one-off tasks. Meta plans to integrate the forthcoming Llama 3 model into consumer devices like WhatsApp and Ray-Ban smart glasses, enhancing user interaction through sophisticated AI-driven assistance. OpenAI also signals upcoming enhancements with GPT-5, focusing on tackling more intricate challenges. This evolution represents a critical shift from generating basic responses to performing tasks that require a deeper understanding and memory, promising a new level of intelligence in everyday technologies.

In March, China experienced a significant 7.5% year-on-year decline in export value, far exceeding analysts’ predictions of a 2.3% drop, alongside an unexpected 1.9% decrease in import value against a forecasted increase. These figures highlight deep-seated economic issues such as reduced global demand, particularly from Europe, and internal deflationary pressures driven by overcapacity in sectors like electric vehicles and renewable energy technologies. This overproduction not only forces down export prices, impacting global markets and heightening competition among manufacturing nations, but it also leads to accusations from Western countries of unfair trade practices like dumping. These developments pose challenges for China’s trade-dependent economic model, prompting calls for increased domestic consumption to offset reliance on exports and mitigate geopolitical tensions while managing the global implications of its pricing strategies on inflation and market dynamics.

In the 2024 fiscal year, Apple (Explore: AAPL) assembled approximately $14 billion worth of its iPhones in India, representing about 14% of its total production, as part of a strategic shift to reduce its dependency on China. This move follows disruptions, including a significant financial impact from a worker revolt at a major Chinese facility in 2022, which prompted Apple to diversify its production base. Foxconn, a Taiwanese firm, accounted for 67% of the Indian-manufactured iPhones, while Pegatron and India’s Tata Group handled the remainder. This diversification strategy is reinforced by Apple’s ongoing retail expansion in India, where it plans to open three more stores by 2027, despite holding a modest 6% share in a market dominated by more affordable Chinese brands. The production in India currently includes models from iPhone 12 to iPhone 15, excluding the higher-end Pro versions.

In the first quarter of this year, Tesla (Explore: TSLA) reported a 9% decline in vehicle deliveries, totalling around 387,000 units, which represents the company’s first quarterly sales decrease since 2020. Despite the drop, Tesla regained its title as the world’s largest EV producer, surpassing Chinese automaker BYD, which experienced an even steeper 42% reduction in its deliveries. This downturn is primarily due to challenges such as factory disruptions, shipping delays, and labour issues. To reinvigorate sales, Tesla has resorted to numerous price reductions and initiated advertising campaigns, deviating from its previous marketing strategies. The overall electric vehicle market is also experiencing softening demand, highlighted by consumer skepticism regarding the environmental efficacy of EVs and persistent concerns about their range and cost.